Employee parking for smart offices Daithí de Buitléir is the Chief Marketing Officer of ParkOffice, a Dublin based startup which optimizes the management of parking lots for companies and landlords. The service is a natural extension of what happens with hot desking management within flexible workplaces and coworking spaces. Learn more about employee parking for smart offices in the...

Business Articles

Business Link: “We are slowly beginning to observe market segmentation in the flexible work space sector”

Based in Stockholm, Skanska Commercial Development Europe counts among the biggest Real Estate Development company in Europe. Skanska owns Business Link, a fast growing coworking brand in Central and Eastern Europe (CEE), currently operating 5 locations, in Poland and in the Czech Republic. We have interviewed Jaroslaw Bator, Managing Director at Business Link & Business Development...

CIC: “We plan to open 50 new coworking locations in the coming 10 years!”

Born a few kilometers away from the Harvard University campus, the Cambridge Innovation Center (CIC) has been a home for great entrepreneurs leading fast-growing companies since 1999. In 2018, CIC raised US$ 58 millions from HB Reavis, the Bratislava based real estate developer. We have interviewed Kari Mruz, the General Manager at CIC Warsaw, to find out more about CIC values, mission,...

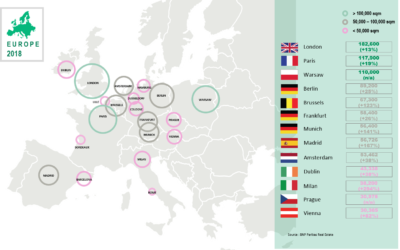

Brussels, Warsaw or Frankfurt are taking over from Paris and London to lead coworking growth in Europe

Coworking has be around for more than a decade in Europe. Nowadays, coworking reaches out to every corner of the continent. BNP Paribas Real Estate released a study spotting the new upcoming coworking hotspots in Europe and what drives the growth. We interviewed Richard Malle, Global Head of Research and Vincent Voute, Senior Research Analyst, to tell us more about their findings. Hello Richard....

“Teleworking at home is good for one day a week. Teleworkers need coworking once the frequency increases”

The percentage of teleworkers has been gradually increasing over the past 20 years in the US. Modern employees demand home-working options but what about teleworking in coworking spaces? How do coworking and teleworking work hand in hand, nowadays, in Europe? We asked Xavier de Mazenod, one of the most famous teleworking and coworking expert in France. Hi Xavier. Can you introduce yourself as...

“Office building landlords will be more and more asked to provide with amenities and community experience”

Petr Boruta is the Marketing Manager at Spaceflow, a platform that provides a global tenant experience platform and community engagement as a service that uplift the experience for people in spaces and buildings. Petr is a well-informed expert of what is happening in the workplace market and below we share some of his thoughts, insights and experience. Hi Petr. Why is Central Europe worth...

JLL: “Nowadays, to dedicate 15-25% of a building to coworking pushes the value of the building up”

Adam Lis, in charge of flexible office solutions at JLL Poland, is a real estate professional with experience in coworking after having worked for Brain Embassy, a Polish coworking brand. We are happy to share below some of his thoughts, ideas and expertise in the field. Hi Adam, what is your take on the relationship between Coworking and the real estate it is located in? As has been pointed out...

Softbank backed OYO bought Innov8 for $31 Mio: “We will deliver great quality experience to real estate customers as well”

Innv8 is among the first coworking brand launched in India. The company was bought by one of the biggest Indian hotel platform, OYO, for a total of 31 millions US$. Meanwhile, OYO announced the takeover of two other coworking brands (PowerStation, for corporations, and Workflow, more focused on startups), demonstrating a strong will to develop its position in the coworking field. Interesting to...

CoWomen: “We are the second space that opened for women only in Europe and we are going to open many more”

Berlin based CoWomen is a community club and a coworking space for "driven women". The space focuses on women on the rise. CoWomen, explain the founders, supports those "women on the rise" to achieve their goals with a workspace with beautiful atmosphere, experts and masterclasses to develop professional and personal skills and community events to find inspiration for the big goals. Hannah Dahl...

“Coworking fills a void in the existing corporate real estate market”

The Coworking Europe 2019 conference took place in Warsaw for its 10th edition. In order to get to know the local ecosystem, we interviewed Konrad Szaruga and Natalia Kuliberda, both real estate experts who shared with us their experience, thoughts and insights about the polish market. Can you introduce yourself and tell us about your past and current involvement in the coworking fields? Konrad...

The workplace is changing.

Let’s shape the future of the workplace together!

Office Location

Somewhere on earth 😉

Between Spain & Belgium

Open Everyday 8am-5pm