Factory Berlin's aim is to become one of the world's biggest hub for innovators. And the goal is partly achieved. In 2018, more than 50% of all the startups created in Berlin were launched from Factory Berlin. Nowadays, Factory Berlin covers a community of 3.000 individual members, 80+ bigger startups, and 40 corporates. Martin Eyerer is the Chief Innovation Officer at Factory Berlin. He...

Coworking Europe Articles

Aticco: “Big coworking brands are slower and therein lies the opportunity of the smaller operators”

Aticco is one of those interesting coworking growth stories which tells us that there is place for independent big players aside of WeWork or Spaces. Aticco is a born and raised coworking firm in Barcelona; a 3 years old brand that has managed to open 6 coworking spaces, around 25.000 m2 all together and without VC investment. We have interviewed Franz Pallerés, the Co-founder and Chief...

Wojo: “By 2022 we expect to open 1.200 coworking addresses all over Europe within Accor hotels.”

In 2019 Nextdoor became Wojo, accelerating its development and creating the ambition to become the leading European coworking network. Two years before, Accor Group, one of the biggest international hotel companies on the planet (operating brands such as Ibis, Mercure, Sofitel, etc.) had taken a 50% share in Nextdoor, by then 100% owned by the real estate company Bouygues Immobilier. We have...

“Don’t put all your efforts on designing a lobby that only looks good on Instagram!”

SocialWorkplaces.com, organizer of the Coworking Europe conference, was invited by Mipim PropTech Europe 2019 to organize a unconference during this month conference in Paris. During two sessions of 1 hour each, we organized discussions with close to 40 participants. Prior to the event, delegates had the opportunity to suggest topics they wanted to be discussed. Participants proposed to cover...

CIC: “We plan to open 50 new coworking locations in the coming 10 years!”

Born a few kilometers away from the Harvard University campus, the Cambridge Innovation Center (CIC) has been a home for great entrepreneurs leading fast-growing companies since 1999. In 2018, CIC raised US$ 58 millions from HB Reavis, the Bratislava based real estate developer. We have interviewed Kari Mruz, the General Manager at CIC Warsaw, to find out more about CIC values, mission,...

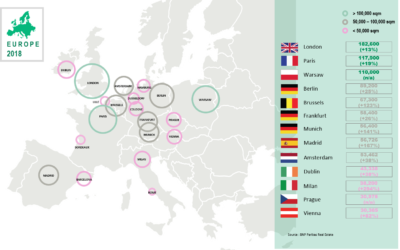

Brussels, Warsaw or Frankfurt are taking over from Paris and London to lead coworking growth in Europe

Coworking has be around for more than a decade in Europe. Nowadays, coworking reaches out to every corner of the continent. BNP Paribas Real Estate released a study spotting the new upcoming coworking hotspots in Europe and what drives the growth. We interviewed Richard Malle, Global Head of Research and Vincent Voute, Senior Research Analyst, to tell us more about their findings. Hello Richard....

CoWomen: “We are the second space that opened for women only in Europe and we are going to open many more”

Berlin based CoWomen is a community club and a coworking space for "driven women". The space focuses on women on the rise. CoWomen, explain the founders, supports those "women on the rise" to achieve their goals with a workspace with beautiful atmosphere, experts and masterclasses to develop professional and personal skills and community events to find inspiration for the big goals. Hannah Dahl...

Primalbase pioneers the blockchain technology based coworking business model

Ralph Manheim is the CEO of Primalbase, a company whose mission is "to provide physical environments for the tech community to realize their ideas and projects". Primalbase works on creating a network where developers researchers and entrepreneurs can come to work, explore and collaborate with others in tech. With that purpose in mind, Primalbase started to open up coworking spaces, offering...

“The growth of flexible workspaces will continue as companies demand greater agility with reduced risk”

Founded in 1999, The Instant Group rethinks workspace on behalf of its clients, injecting flexibility, reducing cost and driving enterprise performance. Instant places more than 7.000 companies a year in flexible workspace such as serviced, managed or coworking offices workspace (Instant Offices hosts more than 12,000 flexible workspace centres across the world). The Instant Group employs 230...

“You don’t take a cut on all positive externalities you made possible” – Mutinerie (Paris)

Mutinerie in Paris used to be the poster child of coworking entrepreneurs in the early 2010's. Launched in the north of the French capital, the ecosystem always sounded genuine and unique, with, back then, one of the most beautiful space design one could experience. Seven years later, the van den Broek brothers and their fellow co-founders have decided to put an end to the story. Coworking is...

The workplace is changing.

Let’s shape the future of the workplace together!

Office Location

Somewhere on earth 😉

Between Spain & Belgium

Open Everyday 8am-5pm