Cécile Peghaire, Director of Communications at Bureaux à Partager

Bureau à Partager is a platform where people and companies can find the best workplace for their teams anywhere in France. Bureau à Partager carried out the Indice du Coworking 2019 survey which showed that one quarter of the coworking French market is in the hands of only four players, two French and two international companies. We have interviewed Cécile Peghaire, responsible for the communication department, to find out more about the French coworking market.

Hi Cécile. One quarter of the coworking French market is in the hands of only 4 players. How do you explain such a concentration?

With the Indice du Coworking 2019 we noticed that the market is splitted between these two main actors. The major ones that have several massive spaces such as WeWork, Morning Coworking, Wojo etc. and the small independent players. The big ones own the biggest coworking spaces in France, that is why they concentrate one quarter of the market in terms of meters square. One of the reasons of this market structure is that the major actors, in France, are almost all supported by big companies (Wojo by Accor, Morning Coworking by Nexity…). They have therefore the financial power to lease the biggest available spaces and then sail through the market more easily than independent companies.

Is the trend strengthening, with a limited number of players taking a bigger slice of the market?

We believe that the two types of actors are going to carry on existing together on the market. They don’t have the same value proposition and are not seeking for the same client. That is why they can coexists together. For instance, small players are emphasizing their actions on communities and freelancers, whereas biggest actors will concentrate on add-ons and services.

Small actors are emphasizing their actions on communities and freelancers, whereas biggest actors will concentrate on add-ons and services.

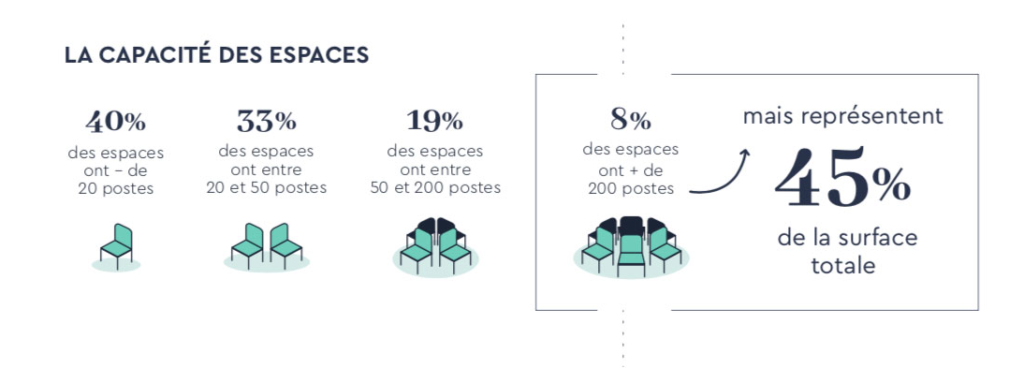

France: 40% of the Coworking spaces have less than 20 desks ; 33% of the Coworking spaces have between 20 and 50 desks; 19% if the Coworking spaces report between 50 and 200 desks; 8% report more than 200 desks, for 45% of the overall coworking surface.

Are international brands driving the growth of the market more than the French local coworking brands?

When WeWork arrived on the French market two years ago, they helped vehicling the concept of coworking in France as they benefit from a great media coverage. At this time, an interest for new ways of working was born and, in a way, thanks to WeWork, French companies start launching their own coworking businesses. Today, both of them are coexisting on the market. Development of the French local brands is slower but also more durable; they don’t have the same strategy but we can’t say that the international brand are driving the growth of the market today.

Thanks to WeWork French companies start launching their own coworking businesses

In the report, you stress on the fact that the coworking market is dual. You actually see two coworking markets. Can you elaborate on that?

We have two main players. On the first hand, the big coworking brands such as Wework, Wellio, Morning Coworking etc., that own several coworking business and are functioning like brands that have a network of spaces. On the other hand, we have little independent coworking spaces. They are smaller and don’t offer the same services. They are also located in smaller towns. They don’t have the same role nor the same clients. That’s why they are not considered to be competitors and that’s the reason why we can talk about two coworking markets.

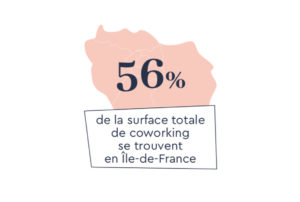

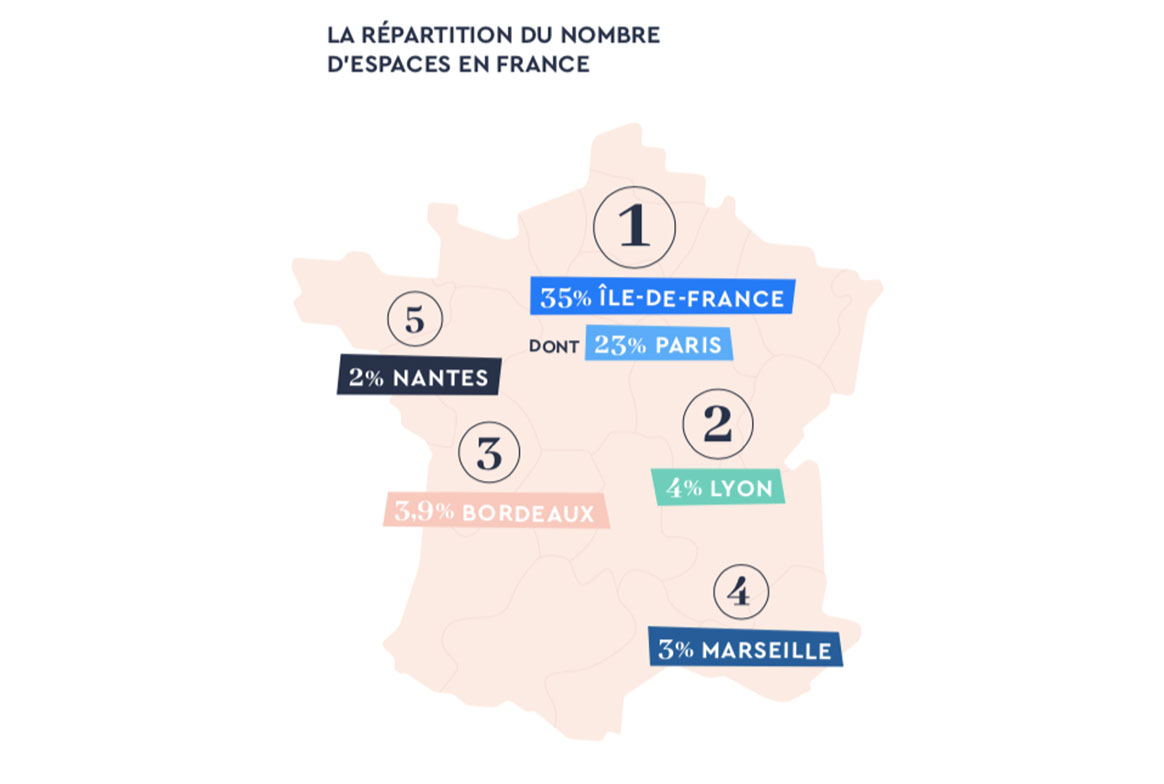

56% of the available coworking surface in France is located in the Paris region. Why is the coworking penetration so weak in the other big French cities?

56% of the overall coworking surface in France is located in the Paris region.

The coworking is a concrete answer to the need of flexibility of the companies. This need is particularly strong in Paris where the real estate market is extremely tense. Historically, most of the companies are settling their offices in Paris Region. Nevertheless, we clearly observe that the coworking market is starting to develop in the French big cities such as Lyon, Marseille, Nantes, Bordeaux. In the middle sized town, we also observe a strong demand for coworking spaces but these spaces are still very small comparing to the huge Parisian coworking spaces. The coworking market is starting to develop in the French big cities such as Lyon, Marseille, Nantes, Bordeaux.

Is Coworking now competing with the regular office market?

Today companies are seeking for flexibility: they want to be able to move easily from one office to another. Also, the office is a high cost for a company and coworking is a smart way to spend less. We clearly think that the coworking market is gradually going to gain some part of the regular office market.

Today companies are seeking for flexibility: they want to be able to move easily from one office to another. Also, the office is a high cost for a company and coworking is a smart way to spend less. We clearly think that the coworking market is gradually going to gain some part of the regular office market.

We clearly think that the coworking market is gradually going to gain some part of the regular office market.

Are there analogies between the coworking and the hotel industry?

Maybe with the emergency of actors such as Bureaux à Partager that give coworking spaces a hand on the commercialisation as Booking.com does on the hotel industry.

How do you see the evolution of the independent coworking spaces in the coming future?

Independent coworking spaces can carry on growing next to big players by developing in smaller cities where biggest actors won’t go. Also, they don’t have the same role; coworking spaces can be seen as social connectors in the smallest cities.

Independent coworking spaces can carry on growing next to big actors by developing in smaller cities where biggest actors won’t go

Remote and online working will have been experienced during the coronavirus craze. Do you expect a rise in demand after this crisis?

Yes. I think that this Corona crisis is very difficult for coworking spaces who have to survive. But if they do, they can expect a huge rise in demand; companies will look very quickly for even more flexibility to be able to adapt their office to the size of their teams.

Join Coworking Europe conference for more insights, data and connections!

0 Comments